Topics

customer lifetime value, customer acquisition vs retention, customer relationship management

Review the activity below or download the PDF student worksheet

- Student worksheet: Leaky Bucket Theory

- Instructor Solutions (Members Only): Leaky Bucket Theory = Solutions

Student Discussion Activity

Customer Lifetime Value and the Leaky Bucket Theory

One of the key goals of marketing is to build a large and loyal customer base who frequently purchase from our firm (or our brands). To achieve this, there are three main components:

- customer acquisition

- growing share-of-customer (getting them to buy more for us

- long-term customer loyalty (retention)

The combination of these elements are key drivers of customer lifetime value (CLV) – or how profitable they are over their customer life time with us.

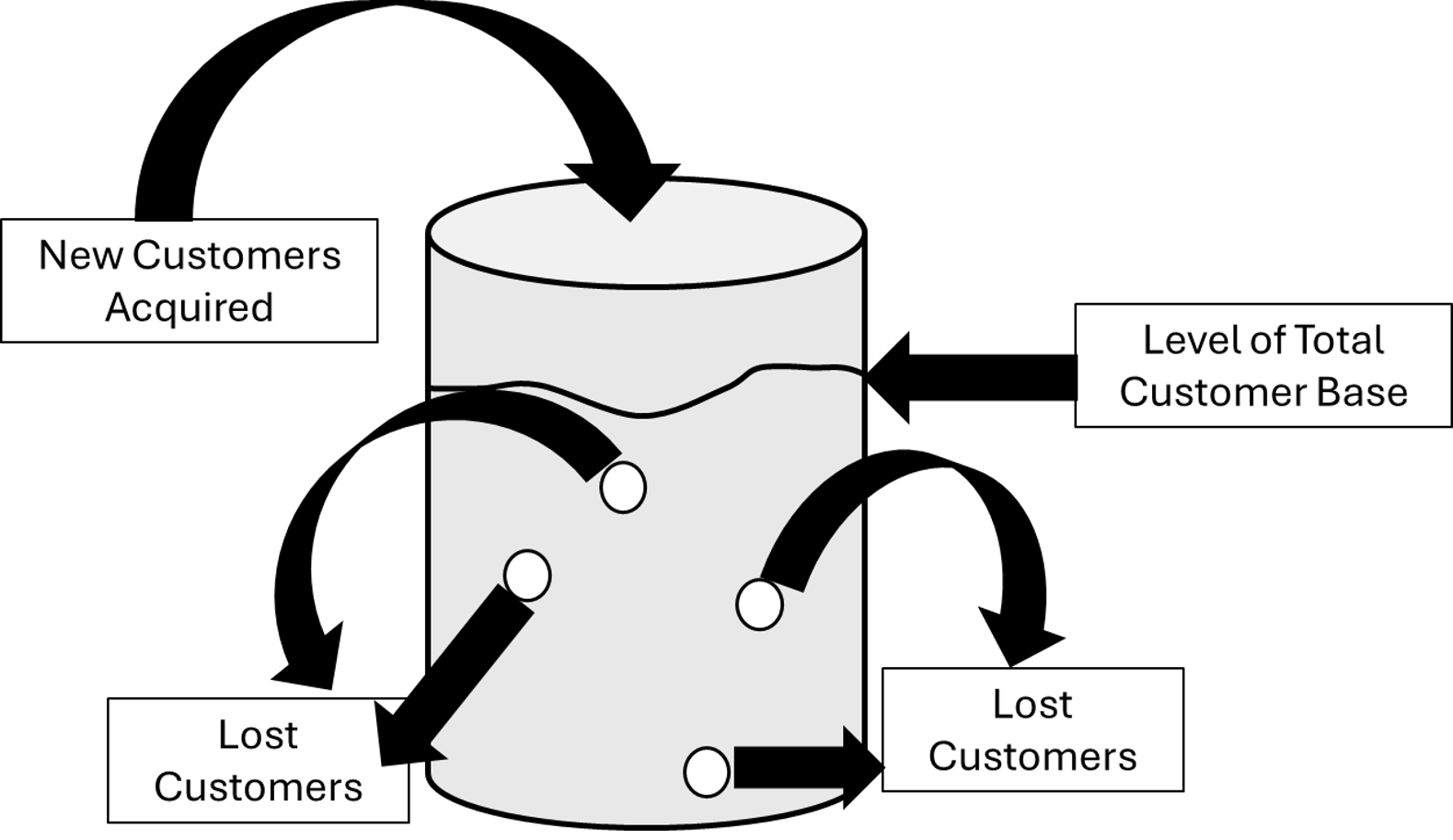

While the leaky bucket theory is more of an analogy than a theory, it looks at points one (acquisition) and three (retention) above. The theory uses a bucket that has several holes in the base and its walls. A hose is put into the bucket and it is filled with water. Some of the water will run out the holes.

In the analogy, water going into the bucket represents new customers being acquired and the water flowing out of the bucket represents customers lost to the firm. The amount of water in the bucket represents the total customer base of the firm at that time, as shown in the simple diagram below:

The analogy is designed to highlight that the firm has two approaches it can take in order to maximize the amount of water in the bucket (that is, the size of the customer base). These two approaches are:

- increasing the water flow into the bucket – in other words, increasing the number of new customers acquired, or

- plug some of the holes in the bucket to reduce the water loss – in other words, concentrating on customer retention.

But which is the best approach? Let’s first recap some CLV basics…

Reminder: Basic CLV Formula

As we know, the simple formula for calculating customer lifetime value is:

CLV = ((revenue pa – costs pa – servicing/loyalty costs pa) X years of a customer) – acquisition cost

Note: Where pa = per annum, or per year

- Let’s use an example:

–$1,000 pa in sales per customer

–$400 pa in cost of product

–$100 pa for loyalty program + direct marketing emails (retention cost)

–Customers stay for 5 years on average (lifetime)

–Costs $2,000 in promotions to win a new customer (acquisition cost)

–CLV = ($1,000 – $400 – $100) X 5 years – $2,000

–CLV = $500 X 5 years – $2,000 = $500

Reminder: Retention Rate

Let’s revisit the customer retention rate each year and how we can then work out the average customer lifetime period in years.

As we should know, the customer retention rate is the % of customers still active/purchasing from us in the next year. So if 750 of our initial 1,000 customers repurchase from us in year 2, then we have an 75% retention rate.

Our customer retention rate is the opposite ratio to our churn (lost customer) rate. For example, with our 75% retention rate, that means that our churn (lost customer rate) is 25%.

We then use the churn rate to work out the average customer lifetime period in years, by using the simple formula of:

Average lifetime of a customer = 1/churn rate

- Let’s use some examples

–Lifetime = 1/10% = 10 years (at 90% retention/loyalty)

–Lifetime = 1/25% = 4 years (at 75% retention/loyalty)

–Lifetime = 1/50% = 2 years (at 50% retention/loyalty)

Student Discussion Questions

- If Company A acquires 2,000 new customers per year and has a 50% retention rate, and Company B only acquires 1,000 new customers per year but has a 80% retention rate – then which company will have the largest customer base after 10 years?

- Briefly describe how Q1 above is connected to the Leaky Bucket Theory?

- Simply based upon this information (in Q1 and Q2), do you think that a firm’s marketing emphasis should mainly focus on new customers or retaining existing customers or both?

- Using the data in the example in the Reminder: Basic CLV Formula section above, which of the two approaches will provide the best improvement to CLV?

-

- The company increases its investment in its loyalty program and related direct marketing emails from $100 per year per customer to $150 – which results in the average lifetime of a customer increasing from 5 to 6 years OR

- The company increases its customer acquisition efforts, which has the effect of increasing its acquisition cost per customer from $2,000 to $2,100 – but they now acquire 1,200 new customers per year, up from 1,000 customers per year.

Related Activities